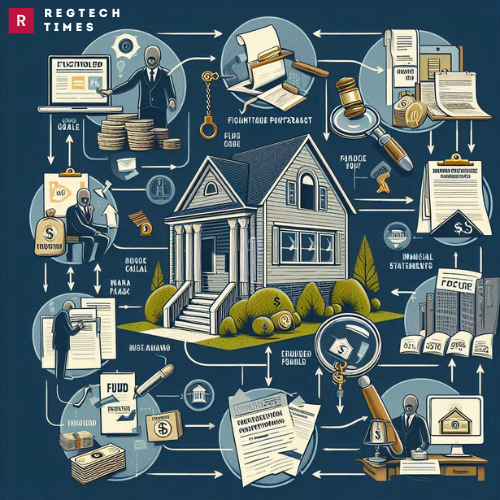

In a significant case of real estate fraud, New Jersey-based investor Aron Puretz has pleaded guilty to orchestrating a multi-year, $54.7 million mortgage fraud conspiracy. The elaborate scheme involved inflating property values and deceiving financial institutions to secure large loans, ultimately acquiring multifamily and commercial properties under fraudulent pretenses.

Aron Puretz: The Architect Behind the Conspiracy Unveiled

From 2016 to 2022, Puretz, aged 53, along with his associates, engaged in a sophisticated conspiracy that fooled lenders into issuing multifamily and commercial mortgage loans. Puretz, who was an employee of Apex Equity Group—a real estate investment and advisory firm—along with his co-conspirators, produced fictitious documents to secure these loans. These documents comprised counterfeit purchase agreements showing inflated prices, fabricated financial statements, and various other fraudulent paperwork.

Key Properties Involved

The conspiracy encompassed several high-value properties across different states:

Maple Lawn, Eureka, Illinois

True Purchase Price: $4.1 million

Fraudulent Purchase Price: $5.8 million

In February 2017, Puretz and his associates used the identity of a co-conspirator to present fraudulent documents to a lender and Freddie Mac. A title and settlement company in Lakewood, New Jersey, performed two closings—one for the actual $4.1 million price and another for the fraudulent $5.8 million price. Additionally, they created a nonprofit entity, JPC Charities, to obtain tax-exempt status, providing false statements to the city of Eureka to secure a property tax exemption.

Big Country Chateau, Little Rock, Arkansas

Acquisition Date: July 2019

In acquiring Big Country Chateau, Puretz employed an associate’s identity, fully aware that both the lender and Freddie Mac would reject his ownership approval. Additionally, he took steps to conceal his ownership and role within the property management company from the Department of Housing and Urban Development and other federal and state agencies.

Troy Technology Park, Troy, Michigan

True Purchase Price: $42.7 million

Fraudulent Purchase Price: $70 million

In September 2020, Puretz and his co-conspirators presented a fraudulent purchase contract to the lender. To support the inflated price, they submitted a fake letter of intent to purchase the property from another party for $68 million, among other fraudulent documents. To cover up the fraud, they arranged a short-term $30 million loan, making it appear that they had the necessary funds for the closing. As with Maple Lawn, a title and settlement company in Lakewood, New Jersey, performed dual closings at true and inflated prices.

Legal Consequences

Puretz admitted guilt to a charge of conspiring to commit wire fraud that impacted a financial institution. He is scheduled to be sentenced on October 30, facing a maximum penalty of five years in prison. The exact sentence will be determined by a federal district court judge, who will consider the U.S. Sentencing Guidelines and other statutory factors.

Securing Your Property Transaction: Risks and Prevention of Conveyancing Fraud

Investigative and Legal Efforts

Principal Deputy Assistant Attorney General Nicole M. Argentieri from the Department of Justice’s Criminal Division, U.S. Attorney Philip R. Sellinger of the District of New Jersey, Inspector General Brian M. Tomney of the FHFA-OIG (Federal Housing Finance Agency Office of Inspector General), and Postal Inspector in Charge Eric Shen of the U.S. Postal Inspection Service’s (USPIS) Criminal Investigations Group jointly announced the case.

California, Florida, and New York are the Hotspots of $2.6 Billion US Real Estate Money Laundering

The FHFA-OIG and USPIS conducted the investigation, with Trial Attorney Siji Moore of the Criminal Division’s Fraud Section and Assistant U.S. Attorney Martha Nye is prosecuting the case for the District of New Jersey.

Implications for the Real Estate Industry

This case highlights the extent to which individuals can exploit the real estate market and financial institutions for personal gain. The fraudulent activities orchestrated by Puretz and his associates were elaborate, involving multiple layers of deception, fake documentation, and the misuse of identities. The dual closings for different purchase prices exemplify the sophisticated means employed to deceive lenders.

The guilty plea and upcoming sentencing of Aron Puretz serve as a stern warning to others engaged in similar fraudulent practices. It highlights the importance of vigilance and due diligence in the real estate and financial sectors to prevent such extensive fraud. The efforts of federal agencies in uncovering and prosecuting this case demonstrate a commitment to maintaining integrity within these industries, protecting both investors and financial institutions from fraudulent schemes.