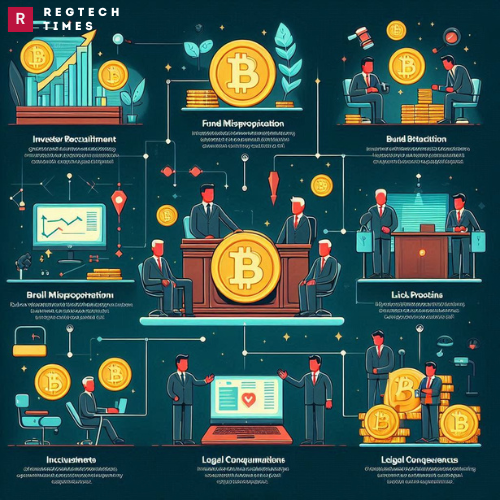

In the dynamic world of cryptocurrency investments, where promises of substantial returns often collide with the complexities of emerging technologies, cases of fraud and deception frequently emerge. The recent guilty plea of Robert Wesley Robb, a Colorado resident charged with wire fraud, serves as a stark reminder of the risks investors face in this burgeoning yet volatile market. Robb’s scheme highlights the allure and peril of unregulated investment opportunities within the cryptocurrency sector.

Robert Wesley Robb’s Fraudulent Tactics

Robert Wesley Robb’s fraudulent operation began with a persuasive pitch on social media, targeting potential investors intrigued by cutting-edge cryptocurrency opportunities. He advertised an investment opportunity in a sophisticated trading bot known as Maximum Extractable Value (MEV), claiming it could deliver substantial returns due to its advanced algorithms and trading capabilities. Central to Robb’s strategy was creating a sense of urgency; he emphasized a narrow window for investment, suggesting that the MEV bot would soon be operational and poised for significant profitability.

Victimizing Investor A

One of Robb’s victims, identified in court documents as Investor A from Brambleton, Virginia, was enticed by Robb’s promises and urgency. Investor A, eager to capitalize on the opportunity, transferred $100,000 to Robb’s Ethereum virtual currency address. This initial investment was made based on Robb’s assurances that the funds would serve as trading capital for the MEV bot, potentially yielding high returns in a short period.

Deceptive Tactics Unveiled

As events unfolded, Robert Wesley Robb’s deception became increasingly apparent. He falsely informed Investor A that a new investor was prepared to inject $300,000 into the scheme, claiming this influx of capital would dilute Investor A’s potential profits. To purportedly safeguard Investor A’s investment from this dilution, Robb persuaded Investor A to send an additional $50,000. These actions underscored Robb’s manipulative tactics, exploiting Investor A’s fear of missing out on significant returns.

Misuse of Investor Funds

Contrary to Robert Wesley Robb’s promises, the funds invested by Investor A and others were not used for their intended purpose. Instead of deploying the capital to initiate trading activities through the MEV bot, Robb diverted the funds to personal accounts. Subsequent investigations revealed a trail of expenditures that painted a picture of lavish personal indulgence. Robb utilized misappropriated funds for luxury items, including high-end vehicles, vacations, and even leasing an executive suite at the Denver Broncos’ Mile High Stadium for personal use.

Broader Impact

The ramifications of Robert Wesley Robb’s fraudulent actions extended beyond Investor A. A comprehensive federal investigation identified more than ten victims who collectively reported losses exceeding $2.2 million. These individuals, like Investor A, entrusted their financial resources to Robb’s scheme in pursuit of promised returns, only to find themselves deceived and financially devastated.

Legal Repercussions

Facing federal charges of wire fraud, Robert Wesley Robb entered a guilty plea, acknowledging his role in orchestrating the fraudulent investment scheme. While Robb faces a maximum penalty of 20 years in prison for wire fraud, the ultimate sentencing decision will be influenced by various factors, including federal sentencing guidelines and statutory considerations. The legal proceedings underscore the serious consequences of financial misconduct within the cryptocurrency sector, emphasizing the importance of regulatory vigilance and investor protection.

Implications for Cryptocurrency Investments

Robert Wesley Robb’s case serves as a cautionary tale amid the rapid expansion of cryptocurrency markets worldwide. It highlights the critical need for investors to exercise caution, conduct thorough due diligence, and maintain a healthy skepticism toward investment opportunities promising guaranteed returns or quick profits. The case also underscores the broader implications for regulatory frameworks governing digital asset investments, as authorities strive to establish robust protections against fraudulent schemes and misconduct.

The case of Robert Wesley Robb illuminates the precarious intersection of innovation and risk within cryptocurrency investments. As digital assets continue to reshape global finance, stakeholders must remain vigilant against fraudulent schemes that exploit investor trust and financial resources. By learning from past frauds and implementing enhanced safeguards, stakeholders can navigate the evolving cryptocurrency landscape responsibly and ethically.