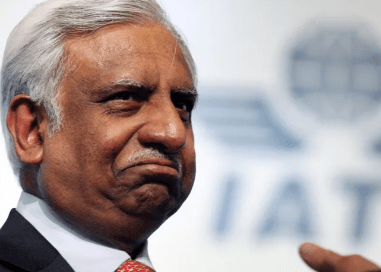

In a Rs 538 crore Canara bank fraud case, the Directorate of Enforcement (ED) arrested Naresh Goyal, ex-Chairman of Jet Airways (India) Limited, on September 1, 2023, under the terms of the Prevention of Money Laundering Act, 2002.

The ED launched an inquiry based on an FIR filed by the CBI BS&FB in New Delhi against M/s Jet Airways (India) Ltd (JIL), Naresh Goyal, and others, claiming cheating, criminal conspiracy, criminal breach of trust, and criminal misconduct.

According to the FIR, Naresh Goyal cheated Canara Bank by syphoning off bank funds with the help of its subsidiaries by showing bogus expenses and illegally diverting the loan proceeds as indicated by the E&Y’s Forensic Audit Reports, resulting in a loss of Rs 538.62 Crore to Canara Bank.

The group’s total non-performing assets (NPA) amount to a substantial figure and a consistent modus operandi has been employed to trigger NPAs across several banks. Here is a breakdown of the NPAs in crores for each bank affected:

- State Bank of India: Rs 1,636.23

- Yes Bank: Rs 1,084.44

- Punjab National Bank: Rs 956.11

- IDBI Bank: Rs 594.43

- Canara Bank: Rs 543.61

- ICICI Bank (Including ICICI Bank – UAE): Rs 529.05

- Bank Of India: Rs 266.12

- Indian Overseas Bank: Rs 171.74

- Syndicate Bank: Rs 169.73

In total, these NPAs add up to a staggering Rs 5,951.46 crores. This pattern of operation has led to a significant financial impact across these banks.

ED had searched for 19.7.2023 at several places, including the Chartered Accountants & Consultants to whom JIL had made huge payments over the years and who had been red-flagged in the forensic audit reports. The ED gathered a considerable number of damning papers, and Naresh Goyal was called thrice but failed to appear before the ED.

An ED investigation revealed that, under the guise of professional and consultancy expenses, dubious expenses totalling Rs 1000 crore were booked, personal expenses of Naresh Goyal and his family members were booked in the company, and unaccounted transactions were credited to the promoters’ foreign accounts. Jet Airways (I) Limited also diverted funds to offshore entities in Dubai, Ireland, and other tax haven countries, including the British Virgin Islands, under the guise of a General Selling Agents commission, which was paid to related parties and entities connected to Naresh Goyal and his associates.

Naresh Goyal was brought before the Hon’ble PMLA Special Court in Mumbai, and the Court granted the ED custody for ten days. More research is being conducted.