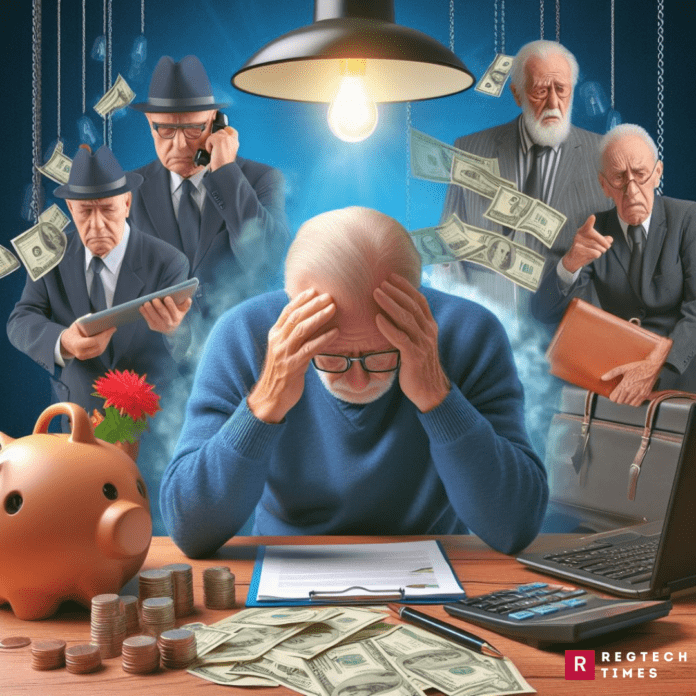

The vulnerability of senior citizens to financial exploitation has become a pressing concern in recent years, as nefarious actors increasingly target them with sophisticated scams and schemes. Recognizing the urgency of addressing this alarming trend, senior advocates and lawmakers have joined forces to introduce bipartisan legislation aimed at combating financial exploitation scams targeting older adults.

The Scope of the Issue:

The prevalence of financial exploitation scams among seniors has reached staggering levels, with individuals reporting losses exceeding $1.6 billion to fraud in 2022 alone. Despite these alarming figures, the true extent of the problem is likely much greater, as the vast majority of frauds go unreported. Investment scams, business impersonation scams, and tech support scams have emerged as particularly lucrative avenues for fraudsters, leading to significant increases in reported losses.

The Legislation:

At the forefront of the fight against financial exploitation is the Protecting Seniors from Emergency Scams Act, introduced by U.S. Reps. Robin Kelly and Troy Balderson. This comprehensive legislation aims to empower seniors with the information and resources they need to recognize and avoid scams. Key provisions of the bill include updating the Federal Trade Commission (FTC) web portal with detailed scam information, collaborating with media outlets and law enforcement agencies to distribute educational materials, and conducting a thorough assessment of the types and frequency of scams targeting older adults.

Support and Endorsement:

The Protecting Seniors from Emergency Scams Act has garnered widespread support from leading advocacy organizations, including AARP, the Elder Justice Coalition, and the American Society on Aging. These groups recognize the urgent need for legislative action to address the growing threat of financial exploitation facing older adults. Additionally, the legislation has received bipartisan support in Congress, underscoring the bipartisan recognition of the importance of protecting seniors from financial predators.

Impact on Seniors:

The rise in financial exploitation scams poses not only a significant financial threat to older adults but also has profound emotional and psychological consequences. Many older adults, particularly those living alone, lack the support networks necessary to identify and report fraudulent activities. As a result, they are disproportionately vulnerable to exploitation, making it imperative to provide them with the tools and knowledge to protect themselves. Moreover, financial exploitation can erode trust and confidence in financial institutions and lead to feelings of shame and embarrassment among victims.

Education and Awareness Efforts:

In response to the escalating threat of financial exploitation, advocacy groups and eldercare service providers have ramped up efforts to educate older adults about common scams and fraud prevention strategies. Through workshops, informational sessions, and partnerships with law enforcement agencies, these organizations aim to empower older adults to recognize red flags and take action to safeguard their financial well-being. Additionally, efforts are underway to raise awareness among caregivers and family members, who play a crucial role in supporting and protecting older adults from financial exploitation.

Conclusion:

The Protecting Seniors from Emergency Scams Act stands as a crucial step forward in the ongoing battle against financial exploitation targeting older adults. By providing older adults with vital information and resources to recognize and avoid scams, this legislation aims to foster a safer environment for aging Americans. However, effectively addressing this complex issue requires a collaborative effort from policymakers, law enforcement agencies, advocacy groups, and the broader community. Together, we must implement proactive strategies, enhance enforcement mechanisms, and raise awareness to shield older adults from the predatory tactics of fraudsters and ensure their financial security and peace of mind.

Moreover, the fight against financial exploitation is not just about protecting older adults’ financial assets; it’s also about upholding their dignity and autonomy as they age. Older adults deserve to live out their golden years free from the fear of falling victim to fraudulent schemes. By fostering a culture of empowerment and support, we can enable older adults to make informed decisions, assert their rights, and protect themselves against exploitation. Together, let us create a society where older adults are valued, respected, and afforded the protections they rightfully deserve as they age with dignity and grace.