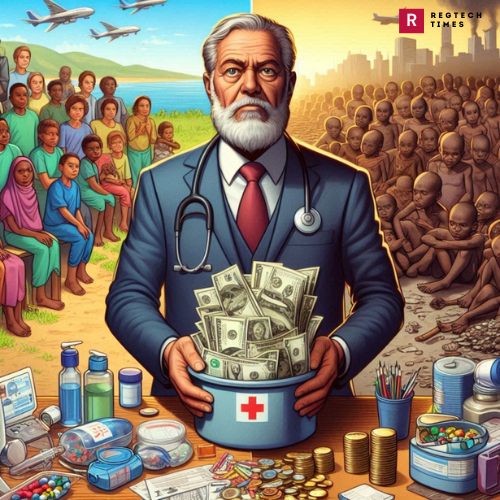

A former president and CEO of a charity organization in Salt Lake City was given a one-year and one-day prison sentence for failing to pay taxes on $1.3 million that was acquired through a covert agreement with an unidentified donor. The former CEO, Ashley Robinson, set up a scam in which medical supplies were misrepresented as gifts to the organization, resulting in large-scale tax losses and personal profit.

Charity Involvement

During Ashley Robinson’s leadership, the organization committed to a commendable goal: locating and providing medical supplies to impoverished areas across the globe. Under Robinson’s leadership, the organization functioned with a strong sense of mission, aiming to reduce suffering and enhance healthcare results in places with insufficient resources. Robinson and his team made numerous lives better by ensuring that essential medical supplies reached people who needed them most through innovative connections and hard work. Their steadfast dedication to providing humanitarian relief highlighted the charity’s critical function in closing healthcare disparities and building resilience in marginalized communities around the world.

Secret Arrangement

Robinson entered into a secretive agreement with Gurcharan “Jazzy” Singh, a purported donor to the charity. Singh supplied medical supplies to the organization, creating the false impression that these items were donations. This clandestine partnership formed the basis of a lucrative profit scheme.

Profit Scheme

Robinson orchestrated a sophisticated scheme whereby he manipulated the perception of donated medical supplies to facilitate their sale to a third party. Through carefully crafted transactions, he created the illusion that these items were generously contributed to the charity, concealing the true nature of the arrangement. Subsequently, the proceeds generated from these sales were predominantly directed back to Gurcharan “Jazzy” Singh, the purported donor involved in the scheme. In exchange for his complicity, Singh rewarded Robinson with a significant share of the profits, amounting to as much as 10% of the total earnings. This clandestine partnership allowed both individuals to profit at the expense of the charity’s integrity and the taxpayers’ trust, perpetuating a cycle of deception and financial exploitation.

Unreported Income and Luxury Lifestyle

Between 2013 and 2019, Robinson personally received $1.3 million from this illicit scheme. Shockingly, he failed to report this substantial income on his federal tax returns or fulfill his tax obligations. Instead, Robinson utilized the ill-gotten funds to pay off his mortgage and indulge in a lavish lifestyle, including the acquisition of luxury vehicles such as a Maserati, a Mercedes Benz, and an Audi for a co-worker.

Tax Loss and Restitution

Robinson’s actions resulted in a staggering tax loss of $485,982 to the IRS, depriving the government of vital revenue. In response to his criminal behavior, U.S. District Judge Jill N. Parish imposed a sentence of one year and one day in prison. Additionally, Robinson was ordered to pay approximately $485,982 in restitution to the United States, highlighting the financial repercussions of his actions.

Singh’s Involvement and Prosecution

Gurcharan “Jazzy” Singh, the purported donor involved in the scheme, faced separate prosecution in the Central District of California. Like Robinson, Singh was sentenced to serve one year and one day in prison for his role in the fraudulent arrangement. The coordinated legal action underscores the severity of their offenses and the commitment to upholding tax laws.

The case of Ashley Robinson serves as a stark reminder of the serious consequences associated with tax evasion, especially for individuals in positions of authority. By exploiting his role as CEO of a charity organization, Robinson not only betrayed the trust of donors and beneficiaries but also deprived the government of essential tax revenue. The sentencing and restitution order send a clear message that financial fraud will not be tolerated, and those who engage in illegal schemes will be held accountable to the fullest extent of the law.