In the intricate world of tax compliance and financial advice, trust and integrity are paramount. However, the recent case involving Jason L. Crace, an Indianapolis-based CPA, has brought to light a stark betrayal of these principles. Crace recently pleaded guilty to charges related to his involvement in an illegal tax shelter scheme spanning nearly a decade, impacting clients across multiple states, including Mississippi.

Allegations against Jason L. Crace

According to court documents and statements, Jason L. Crace engaged in preparing false income tax returns for his clients between 2013 and 2022. These returns claimed substantial deductions under the guise of “royalty payments.” These purported payments, however, were not genuine business expenses but rather a convoluted financial maneuver designed to deceive tax authorities.

Operation of the Scheme

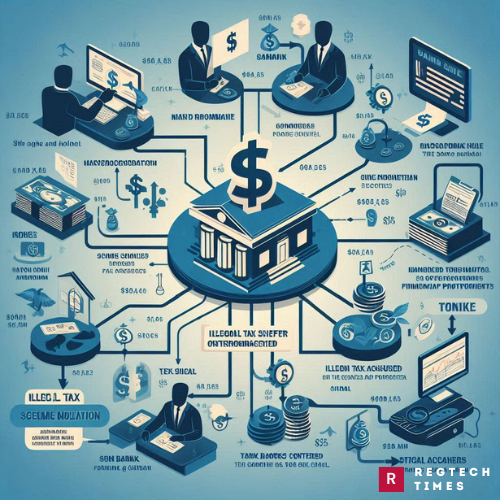

The scheme, orchestrated by Jason L. Crace and others, involved clients transferring funds to accounts controlled by scheme promoters. These promoters would then cycle the money back to different accounts under the clients’ control. This circular flow of funds created the illusion of legitimate business transactions involving royalties, allowing clients to wrongfully deduct these amounts from their taxable income.

Impact and Consequences of Jason L. Crace’s Actions

The repercussions of Jason L. Crace’s actions were significant, causing the Internal Revenue Service (IRS) to suffer a loss totaling at least $2,532,936. This loss highlights the severity of the financial deception perpetrated through the misuse of tax laws. Such actions not only defraud the government of legitimate tax revenue but also undermine the integrity of the tax system as a whole.

Legal Proceedings and Accountability for Jason L. Crace

Jason L. Crace’s admission of guilt represents a pivotal milestone in the legal proceedings. He potentially faces up to three years in prison, in addition to supervised release, restitution, and financial penalties. The sentencing, scheduled for January 14, 2025, will ultimately be determined by a federal district court judge, who will consider sentencing guidelines and statutory factors.

The investigation into Jason L. Crace’s activities was spearheaded by the IRS Criminal Investigation Unit, reflecting the government’s commitment to combating financial fraud and ensuring tax compliance. The case is being prosecuted by trial attorneys from the Justice Department’s Tax Division and the U.S. Attorney’s Office for the Southern District of Mississippi, highlighting the severity with which such financial misconduct is treated under federal law.

Lessons Learned and Industry Impact

The case of Jason L. Crace serves as a reminder of the consequences of financial misconduct within the accounting and tax advisory professions. CPAs and financial advisors are entrusted with sensitive financial information, and their clients rely on their expertise to navigate complex tax laws legitimately. When this trust is breached, as in Crace’s case, the repercussions are not just legal but also ethical and professional.

The broader financial and legal sectors will closely follow Jason L. Crace’s sentencing and the outcome of his case. This scrutiny highlights the essential requirement for transparency, accountability, and ethical behavior within financial advisory services. Clients must be assured that their financial advisors operate with integrity and adhere to legal standards, safeguarding both their financial interests and the credibility of the profession.

Jason L. Crace’s guilty plea in the illegal tax shelter scheme has shed light on a troubling breach of trust and legal obligation. The repercussions of his actions extend beyond personal accountability to the broader implications for tax compliance and financial integrity. As the legal process unfolds, stakeholders in the financial and legal sectors will be closely watching, emphasizing the critical need for transparency, accountability, and ethical conduct in financial advisory services.

The case of Jason L. Crace serves as a poignant reminder of the importance of upholding ethical standards in all financial practices and ensuring trust and accountability in the financial advisory profession. As Jason L. Crace awaits sentencing, the impact of his actions on the tax system and the accounting profession highlights the ongoing challenges in combating financial fraud and maintaining public trust in financial services.