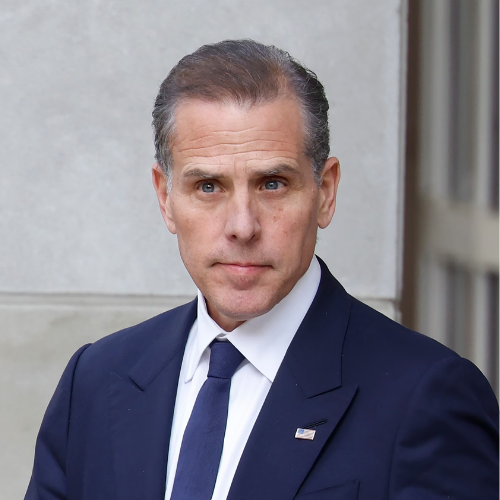

Hunter Biden, the son of U.S. President Joe Biden, is once again in the legal spotlight as a federal judge recently rejected his bid to dismiss a tax evasion case in California. This development marks a significant setback for Hunter Biden, whose legal troubles have become a focal point of public and political scrutiny. As the case moves toward a September trial, the allegations against him for failing to pay taxes on substantial income continue to attract attention.

Hunter Biden’s Tax Evasion Case: The Core Allegations

At the heart of Hunter Biden’s legal challenges is the accusation of tax evasion. Federal prosecutors have charged him with failing to pay taxes on income earned over several years, an offense that could result in serious legal consequences. The charges assert that he deliberately avoided his tax obligations, leading to the current federal indictment. Despite the gravity of these charges, Hunter Biden has consistently pleaded not guilty, maintaining his innocence as the case progresses.

The tax evasion charges are particularly significant because they add to the narrative of Hunter Biden’s controversial business dealings and personal conduct, which have been the subject of intense public interest. Critics have pointed to these charges as evidence of broader issues, while supporters argue that Hunter is being unfairly targeted due to his father’s position.

Legal Maneuvers: Attempt to Dismiss the Case

In an effort to have the tax evasion charges dismissed, Hunter Biden’s legal team mounted a defense centered on the appointment of David Weiss, the special counsel overseeing both the tax case and a separate gun-related conviction. Biden’s lawyers argued that Weiss’s appointment was unconstitutional, citing a recent ruling in a case involving former President Donald Trump as a precedent.

Hunter Biden, Burisma Holdings & Russian Terrorism Probe

In the Trump case, a Florida judge dismissed charges related to the illegal retention of classified documents, ruling that the special counsel in that case, Jack Smith, had been appointed without proper congressional authorization. Hunter Biden’s defense team sought to apply the same logic, contending that if Smith’s appointment was unconstitutional, then the charges against him should also be dismissed.

Judge’s Ruling: Upholding the Indictment

However, Hunter Biden’s strategy hit a significant roadblock when U.S. District Judge Mark Scarsi in Los Angeles denied the motion to dismiss the tax evasion charges. In his decision, Judge Scarsi stated that there was no valid basis to reconsider an earlier ruling that had already denied Hunter Biden’s motion. The judge made it clear that the legal reasoning from the Trump case did not apply to this situation.

Hunter Biden Convicted on Firearms Charges, Faces Upcoming Tax Crimes Trial

Judge Scarsi wrote that the merits of the motion would not be reached because no valid basis for reconsideration of the court’s order denying Mr. Biden’s motion to dismiss was found. This ruling ensures that the tax evasion charges against Hunter Biden will proceed to trial, keeping the case—and himself—under intense scrutiny.

Broader Implications and Political Fallout

The continuation of the tax evasion case is a significant development for Hunter Biden, whose legal troubles have become a persistent issue for the Biden administration. As the trial date approaches, the case could have far-reaching implications, not just for himself personally but also for his father’s political standing. The trial is expected to draw extensive media coverage, and any developments could be used by political opponents to challenge the Biden administration’s integrity.

For Hunter Biden, the stakes are incredibly high. A conviction on tax evasion charges could result in serious legal penalties, further damaging his reputation and complicating his future. Moreover, the case serves as a reminder of the complex legal and ethical challenges that can arise when family members of high-ranking officials face criminal charges.